Income Tax Return(ITR)-

Every Individual whose total yearly income comes in specified salary range has to file the ITR for that year.

Income Tax Return (ITR) is a form in which the taxpayers file information about his income earned and tax applicable to the income tax department.

Every taxpayer should file his ITR on or before the specified due date.

There are varioous type of form are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7 , an individual can choose ITR forms depending on the sources of

income , the amount of the income earned and the category the taxpayer belongs to like individuals, HUF, company, etc.

To make the filling process easy,the Income Tax Department provides the facility for electronic filing (e-filing) of an income tax return.

Below are the different types of ITR forms-

1-ITR-1 OR SAHAJ :ITR-1 SAHAJ is for individuals having income from salaries, one house property, other sourses etc.

You can use this form if your income source is any of the following-

Salary

Pension

Profit or loss from One House Property

Other income (not from lottery, winning or rare horses)

Any exempted income ( Agriculture income not more than 5000 ).

ITR-2 : ITR-2 is for individuals and HUF, having income from business or Profession and capital gain and who hold foreign assets.

You can use this form if your income source is any of the following-

Income from salary/ Pension

Income from House Property. The house property can be more than one.

Share of profits or partner from a partnership firm

Capital gain/loss on sale of any investment or property

Income from other sources . You can include the income from lottery, winning and race horse.

Exempt income such as EPF, PPF, insurance, and agriculture income. In this form, you can report the agriculture income of more than 5,000.

Clubbed income of family member. The income of the family member should be any of the above categories

Any Foreign income/Foreign Asset

ITR-3:ITR-3 is for individuals and HUF having income from a proprietary business or profession.

you can use this form if your income source is any of the following-

Income from proprietary business or profession (mandatory)

Salary /Pension

Profit & loss from one or more house property

Capital gain / loss on sale of any investments or property

Other income (including lottery, winning & race horse )

Any exempt income

Any foreign income / asset

Share of profit or partner from partnership firm

ITR-4 or Sugam: ITR-4 is for Presumptive business income tax return.

you can use this form if your income source is any of the following-

Income from presumptive business

Salary/Pension

Profit & loss from one house property

Other income (not from lottery , winning or race horses )

Any exempted income

ITR-5:

ITR 5 is for firms, LLPs (Limited Liability Partnership), AOPs (Association of Persons), BOIs (Body of Individuals),

Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, Business trust and investment fund.

ITR-6:

ITR-6 form is to be used only by companies except those companies or organizations that claim tax exemption as per Section 11.

ITR-7:

ITR-7 income tax form is to be filed by individuals or companies

Tax Slabs-

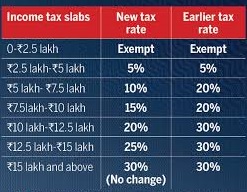

In new budget, Govt of India has declared new tax slab and has provided the tax player a choice to choose new tax slab or new tax slab

if they find old tax slab was suitable for the tax payer

Below table shows new tax slab as well as the old tax slab.

Now the question comes how to file ITR-

The steps involved in the filing of an income tax return are:

Step 1: Determine your filing status.

At a first step you need to determine your filing status, it means how you want to file your tax.

Ex. you and your wife are running a business or a coaching institute then you have the option to file jointly.

If you file your taxes jointly with your spouse, you are required to add all of your income together to determine the total.You can combine your deductions, and you pay your taxes jointly.

Even if you are married and if want to file the ITR separately then divide your income,calculate your deductions and you pay your taxes separately.

Here both of you can’t use the same expenses to calculate the amount of your separate deductions.

Step 2: Calculate you gross income.

The IRS requires you to report all of your income.

All of your income means your total income from all of your sources e.g. Income from business/salary, income from rent if you have given your house on rent, income from bank interest if interest etc.

Your total gross income is determined by adding up all types of income that you have received during the calendar/tax year.

Step 3: Calculate your deductions.

1-If you have invested in EPF/PPF then add amount you have invested in PPF in deduction list.

2-If you have taken Tax Saving FD then add that too in deduction list.

3-Any LIC or any other policy.

4- you can show you child's education fee in deduction also.

5-If you are staying in rent then you can show house rent in deduction.

6-Premium paid in medical insurace for your self and parent.

7-If you have taken home loan and paying EMI then can show interest amount in deduction.

8-Income from bank interest is tax free till 10000(incluing all of your bank accounts) so if you getting bank interest 11000 from bank on you saving

then you have to pay taxes only on 1000 Rupee only.

Step 4: Calculate your Taxable income.

The amount comes after adding all types of income is not a taxaable income means you don't have to pay taxes on your gross income.

so you need calculate you taxable income also before filing the tax for the year.

To calculate the taxable income-

minus the deduction amount from your gross income, the amount which comes after minus is your taxable income.

Step-5: calculate you tax.

Now calculate your tax based to the Tax Slab table given above.

Step-6 :

Login to www.incometaxindiaefiling.gov.in portal .

Step-7 :Choose the right Income Tax Form

Step-8 :Fill in your details in the form

Step-9 :Validate the information entered

Step-10:Submit the form, download the form and send it to

CPC, Bengaluru.

Tax payer can e-verify their reurn also, and that way they don't have to sent to form to CPC banglore.

Tax payer can e-verify the form using his adhar or bank account.